do travel nurses pay state taxes

These stipends and reimbursements are for expenses such as meals parking transportation fees and. As you start packing those bags keep in mind this.

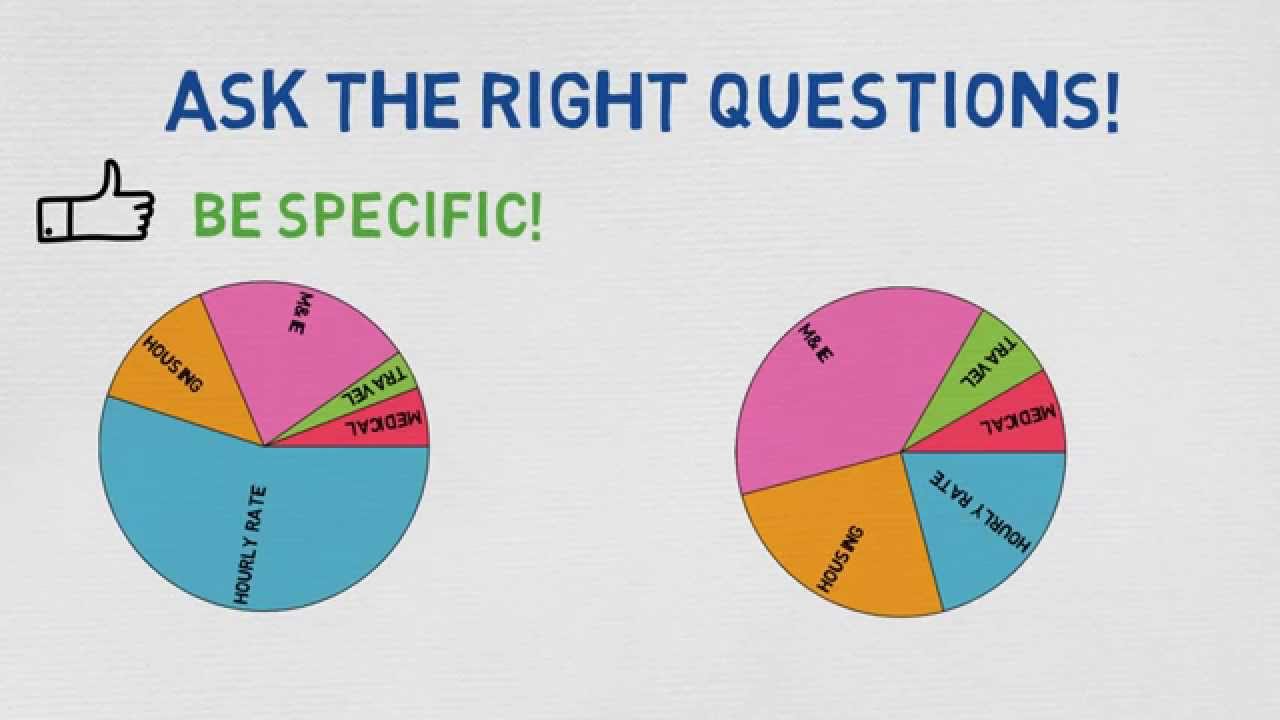

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

It is also the most important since the determination of whether per diems.

. First your home state will tax all income earned everywhere regardless of source. This is the most common Tax Questions of Travel Nurses we receive all year. 12 for taxable income between 9876 and 40125.

10 for the first 9875 in taxable income. Typically there are stipends or reimbursements for travel nurses. Deciphering the travel nursing pay structure and tax rules can be complicated.

Make sure to check state laws as you may end up paying. 22 for taxable income between 40126 and 85525. Either way the faster.

Make sure you qualify for all non-taxed per. The following nine tips can make filing your travel nurse taxes easier save you money and help you avoid future tax liability. Two basic principles are at work here.

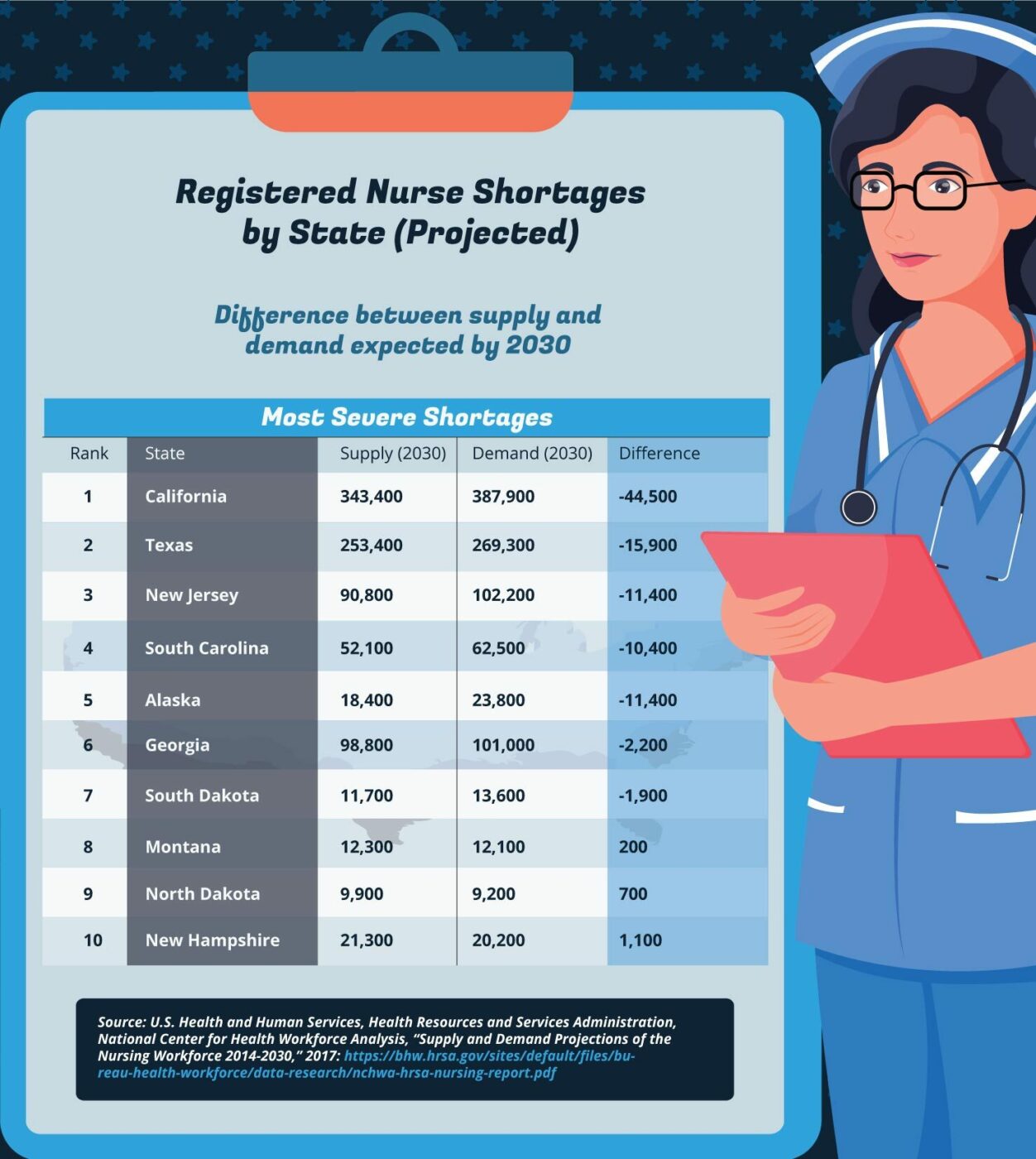

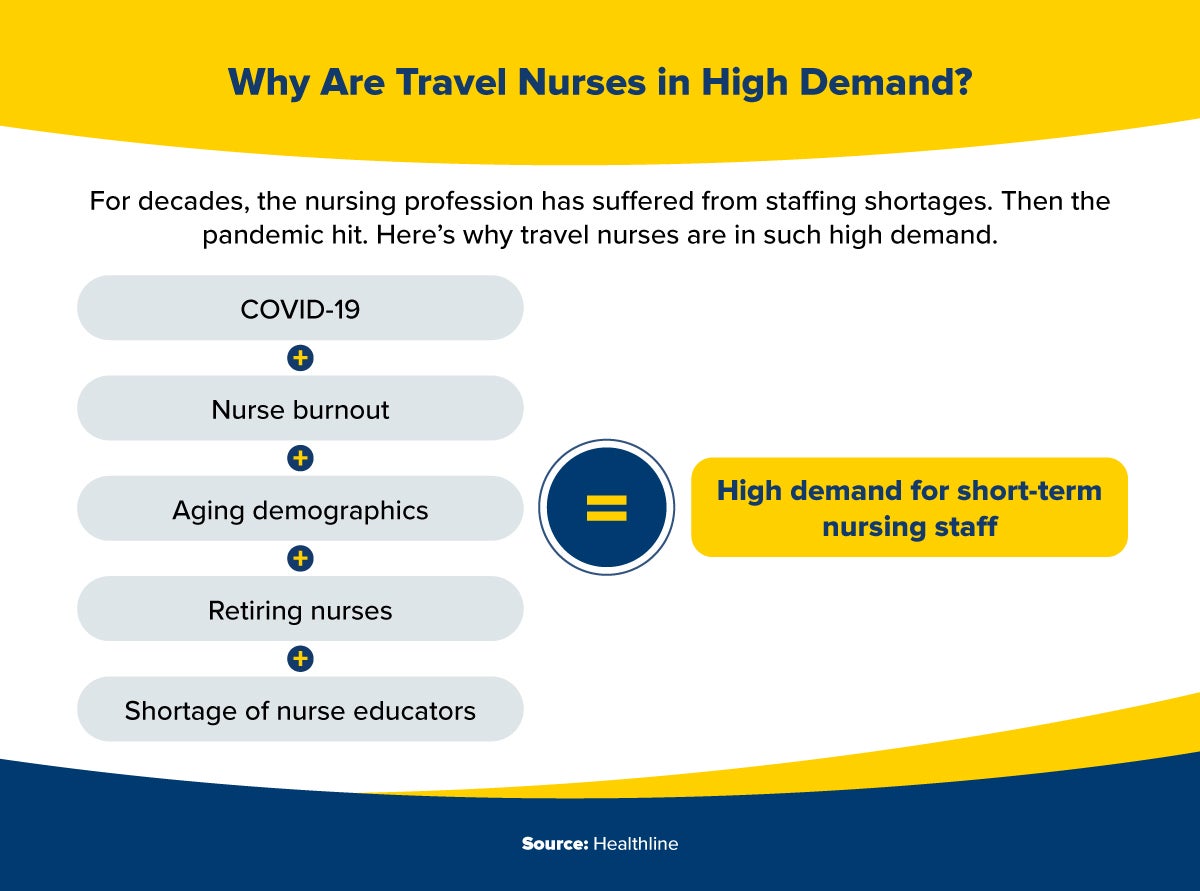

Also nurses are free to go anywhere in their. Tax homes tax-free stipends hourly wages. Apply for the Job in Operating Room Nurse RN - Travel Nurse at Amarillo TX.

The date to file your taxes by this year is Monday April 18 2022. You will pay state income taxes in whichever state you work. 1099 employees expecting to owe.

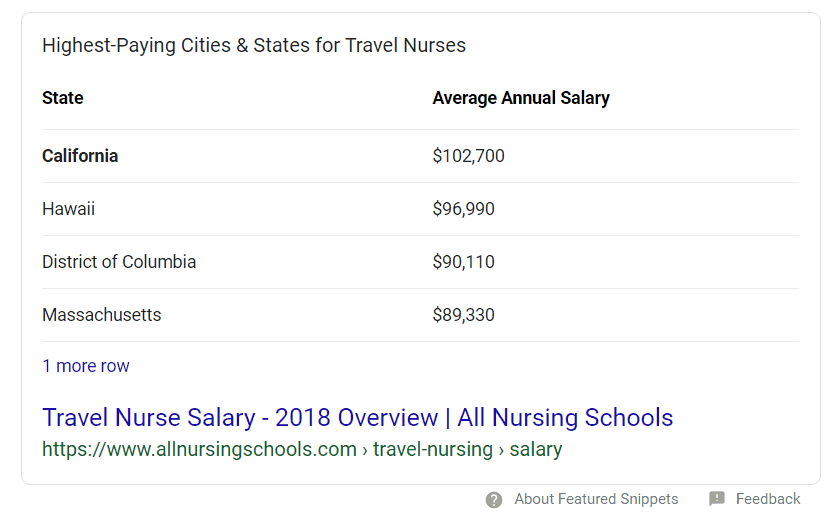

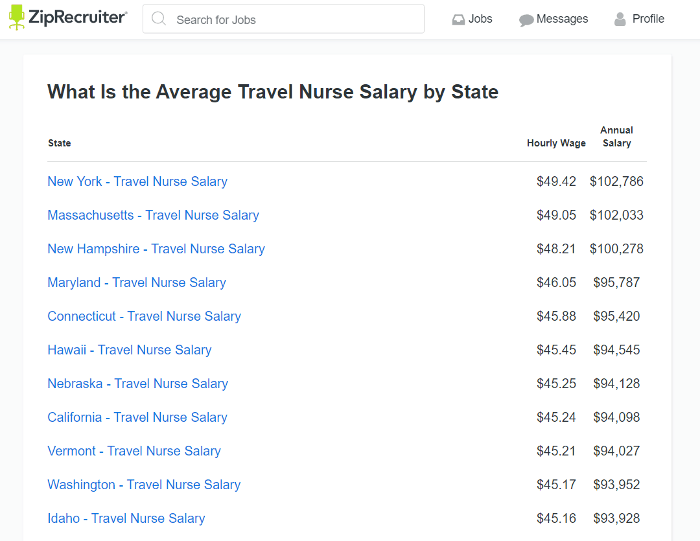

Where do travel nurses pay state income taxes. This is because travel nurses are paid a base hourly rate that is taxable and a weekly travel stipend that is not taxable both of which equal their total pay in a given. What taxes do travel nurses pay.

Prestigious Facilities with Best-in-Class Benefits. The fact that the income was not earned in the home state is. For travelers stipends are tax-free when they are used to cover duplicated expenses such as lodging and meals and do not have to be reported as taxable income.

Expand Your Nursing Career. May 9 2019. Therefore we must prove that we have a home to go away from.

You can file taxes yourself using IRS e-file or hire a tax professional to file for you. Travel nurses are granted tax-free stipends and travel nurses save up to 10k annually compared to permanent nurses. 24 for taxable income between.

Federal income taxes according to your tax bracket. Basically only income earned in California is taxed there. Not just at tax time.

Okay so we are learning as a Travel Nurse we must travel away from home to receive that tax-free money. State travel tax for Travel Nurses. Travel Nurse Tax Deductions such as Tax-Free Stipends and Reimbursements Tax Homes Reasons for Taxable Income and Tips to pay less.

You may need to pay four taxes as an independent contractor. But many states including California use a percentage based approach to figuring out taxes due plus. As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees.

View the job description responsibilities and qualifications for this position. In this Travel Nursing Tax Guide we will cover. For more on how state income tax impacts travel nurse salary seek the advice of a tax professional who is familiar with filing state income taxes for travel healthcare professionals.

If your tax home is established in a state that DOES. Typically Travel Nurses receive a lower base pay than permanent Pros with the difference made up by non-taxable reimbursements. Ad TNAA has Experts in Housing Payroll Clinical Care.

Here When You Need Us. By Rachel Norton BSN RN.

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How Much Do Travel Nurses Make Factors That Stack On The Cash

How To Make The Most Money As A Travel Nurse

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

What Is Travel Nursing Academia Labs

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Travel Tax The Travel Nurse S Guide To Taxes Travel Nursing

A Guide To Travel Nursing In Your Own City And State Trusted Nurse Staffing

Pros And Cons Of A Travel Nurse Spring Arbor University Online

How Much Do Travel Nurses Make Nursejournal Org

Travel Nurse Tax Faq With The Founder Of Travel Tax Youtube

Everything You Need To Understand About Traveling Nursing Taxes

How To Calculate Travel Nursing Net Pay Bluepipes Blog

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing